Trick Aspects to Take Into Consideration When Selecting the Right Accountancy Technique

Choosing the appropriate audit practice is a critical choice that can considerably impact your economic wellness and overall organization success. Key aspects such as the professionals' qualifications, their areas of expertise, and the variety of solutions provided need to be meticulously assessed. Additionally, reliable interaction and openness in fee structures are essential for cultivating a productive collaboration. As you think about these components, it's vital to additionally assess the importance of customer evaluations and the company's credibility. What other elements should one contemplate to ensure an ideal choice?

Know-how and Qualifications

In the world of accountancy, proficiency and certifications serve as the cornerstone for reliable monetary monitoring. When selecting an audit technique, it is critical to consider the credentials of the professionals involved.

In addition, expertise within the accountancy area can significantly influence the high quality of services provided. Some experts concentrate on locations such as tax obligation prep work, bookkeeping, or forensic accountancy, which can provide a much more extensive understanding of specific customer needs. In addition, market experience is crucial; accounting professionals with a tried and tested record in your particular industry will be much more adept at navigating the distinct economic challenges you may deal with.

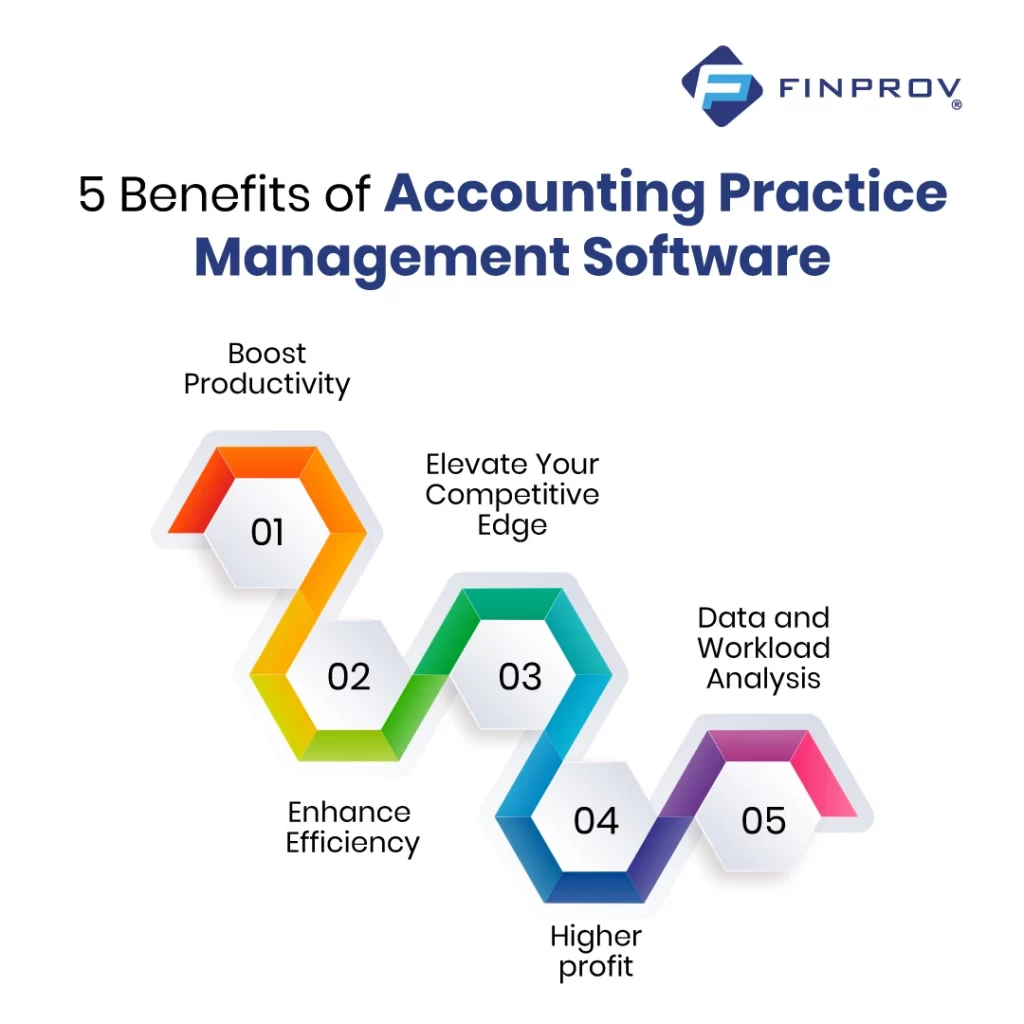

Lastly, innovation effectiveness plays an essential duty in modern accounting practices. With the enhancing dependence on audit software application and financial analytics, making certain that the method uses experts who are adept with these devices can improve accuracy and efficiency in financial reporting. Succentrix can help you start an accounting practice. Choosing a company with the best experience and qualifications will eventually lead to appear financial decision-making

Range of Providers

Services, particularly, must take into consideration firms that supply tailored solutions relevant to their sector. For circumstances, a technique experienced in taking care of the intricacies of production or non-profit markets can give insights and services that common firms may neglect. Extra services such as payroll management, company valuation, and sequence preparation can be important as firms expand and progress.

Additionally, guarantee that the accountancy method remains updated with the most current guidelines and technological improvements, as this can substantially enhance the high quality of solution offered. Eventually, a company that supplies a large range of solutions is much better placed to work as a long-lasting companion, with the ability of adapting its offerings to suit your altering financial landscape. This versatility can contribute substantially to your business's general success and economic wellness.

Communication and Accessibility

Efficient interaction and accessibility are vital factors when picking an audit method, as they straight affect the high quality of the client-firm connection. A firm that focuses on clear and open interaction cultivates trust and guarantees that clients feel valued and understood. It is vital to review how a technique connects important information, whether with regular updates, timely responses to inquiries, or the capability to describe intricate economic concepts in layperson's terms.

Availability is similarly crucial; clients must feel positive that they can reach their accountants when required. This includes thinking about the firm's operating hours, availability for assessments, and responsiveness via various channels, such as phone, e-mail, or in-person meetings.

Additionally, innovation plays a critical function in boosting interaction and access. A practice that leverages modern interaction devices, such as safe customer sites or mobile apps, can facilitate details sharing and make it simpler for customers to access their financial data anytime, anywhere. Ultimately, a firm that masters interaction and availability will certainly not only simplify the audit procedure but also develop a strong, long-lasting partnership with its clients, ensuring their needs are satisfied successfully.

Fee Structure and Openness

Comprehending the fee structure and ensuring transparency are essential facets when examining an audit practice. A clear and in-depth charge framework allows customers to prepare for prices and budget accordingly, reducing the possibility for misconceptions or unanticipated expenses. It is important to make inquiries whether the technique makes use of a set fee, per hour price, or a mix of both, as this can considerably impact general expenses.

Furthermore, transparency in payment practices is vital (Succentrix can help you start an accounting practice). Customers must get clear billings detailing solutions rendered, time spent, and any type of surcharges. This level of detail not just fosters count on however additionally makes it possible for customers to examine the value of the services provided

Last but not least, think about whether the accounting technique agrees to offer written arrangements that outline all solutions and associated fees. This can act as a secure versus shocks and makes sure both events have a good understanding of expectations. By prioritizing cost structure and openness, clients can make informed choices that align with their financial objectives.

Customer Reviews and Track Record

Many clients find that the online reputation of an audit technique plays an important function in their decision-making process. A well-regarded company is frequently associated with integrity, professionalism, and expertise. Clients frequently choose evaluations and endorsements to gauge the experiences of others, which can substantially affect their choice of accountancy solution.

Furthermore, it is advisable to check out the practice's record relative to compliance and ethical standards. A firm that has dealt with disciplinary activities may present a risk to your financial stability.

Verdict

Finally, selecting a proper accountancy method demands cautious examination of numerous crucial aspects. Expertise and credentials, consisting of appropriate certifications, considerably effect the high quality of solution. The range of solutions used should align with certain demands, while effective communication and availability foster an effective partnership. A clear cost framework is vital to avoid prospective misunderstandings. Complete read what he said research study into customer testimonials and the company's total reputation gives beneficial insights right into integrity and professionalism and trust, making sure educated decision-making.